2018-06-20

Seminar on Sino-US Trade Disputes

In continuation of its Seminar Series, the School of management of Jiangsu University held another insightful seminar focused on how the SINO-US Trade Dispute started, its dynamics and how everyone is affected.

To lead this seminar was a faculty expert from Fresno Pacific University’s School, Professor Pengcheng Wen, Ph.D of Business Administration.

THE BACKGROUND

Any country’s total supply should be equal to the country’s total demand. This statement is confirmed in the basic Economics equation, known as the GDP function:

Y= C+I+G+(X-M), where

Y = Gross Domestic Product (which is the total value of good/services supplied) ; C = Consumption by its citizens ; G = Government expenditure/consumption ; X = exports ; M = Imports

The left side represents the supply side while the left side of the equation is the demand side.

He explained that an interaction between a nation’s imports and exports is what gives rise to either a trade deficit or a trade surplus. He, however, was quick to add that while a trade deficit (where a country imports more than it consumes) is a debt situation which may generally be frowned on, it is not entirely bad in the short term. The same with trade surplus (where a nation exports more than it imports); in the short term it isn’t a bad thing. However, a country experiencing either of these two condition over a long term has its repercussions.

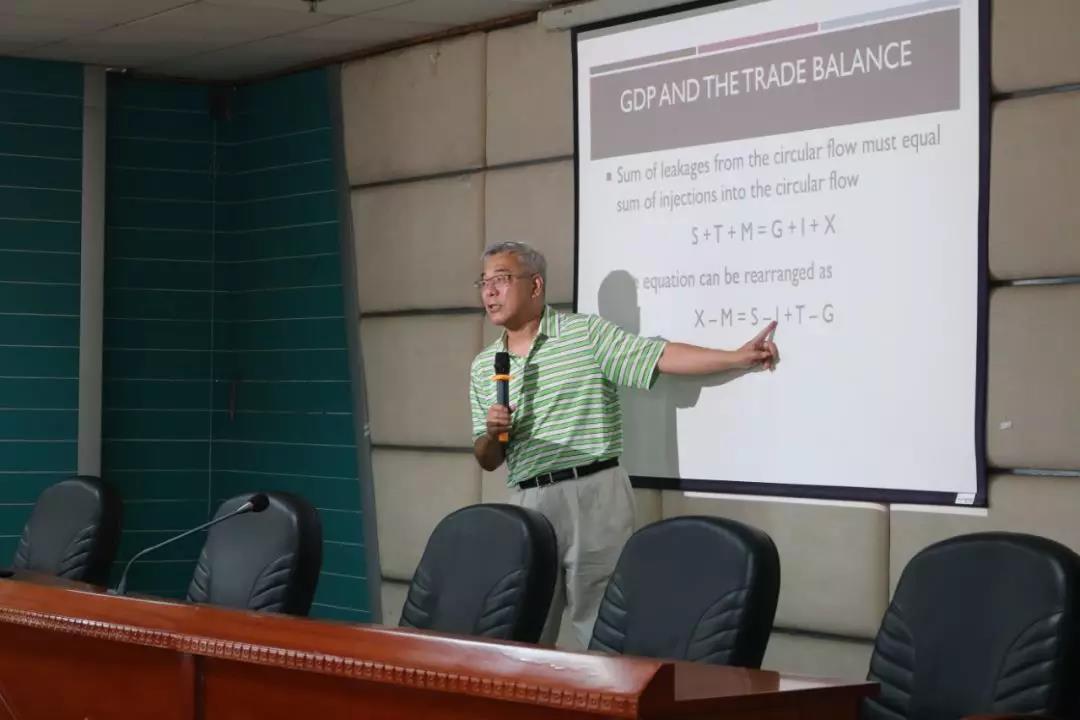

THE LEAKAGE AND INJECTION PROBLEM

He explained that every economy has ‘leakages’ and ‘injections’ found within the GDP function must interact well for there to be some level of sustainability and growth within an economy.

Leakages: These are items that restrict the growth of the GDP. They include: savings (because savings make citizens spend less on goods and services), taxes (taxes take away disposable income from citizens), imports (imports make citizens purchase less of their own products).

Injections: These are items that pump cash into the economy. They include investments (which is made by banks with the savings, given out as loans to businesses), government spending (which is made on behalf of the citizens from taxes taken), and exports (also referred to as foreigners purchases)

Based on the prior GDP function, S + T + M = G + I + X. Meaning Leakages should be equal to injections. In other words, S=I (which leads to a money market equilibrium), T=G (leading to a Fiscal equilibrium), and X=M (leading to international equilibrium)

THE BASIS OF THE TRADE DISPUTE

In reference to the GDP function, the Professor explained that any nation’s X-M = S - I + T- G.

However the following is the case with USA and China:

The professor proposed the following solutions for the two nations, also based on the aforementioned assumptions:

USA (for trade deficit):

1. Increase/encourage citizens to increase the savings rate

2. Increase government taxes.

3. Decrease Business Investment

4. Decrease government spending

CHINA (trade surplus):

1. Decrease private savings

2. Decrease government taxes

3. Increase business investment

4. Increase government spending

WHY IS THE USA GIVING CHINA SO MUCH PRESSURE

Despite increased competition from other countries, the USA seems to focus its energies on China. The Professor enumerated the following reason why this could be the case:

1. In 2010, China became the fastest growing economy in the world

2. In 2012 China became the 2nd largest trading country in the world. China accounted for 14.6% of global trade

3. Since 2012, the USA was no longer the manufacturing country. China is.

4. China has accumulated about $4trillion in foreign reserves. This is twice what all 52 states in America require to facilitate their economies

5. Income per person per capita is now $8000. This brings household (of 4 people) income to about $32000.

6. In 2017, according to Forbes Magazine, out of the 500 best companies in the world Chinese firms were 120 in total

7. Patent applications by Chinese firms is now ranked 3rd in the world, only after USA and Germany

8. China has the 2nd largest equity market and 3rd largest bond market in the world

When asked whether there could be a possible trade war emerging from this dispute, the Professor was confident there won’t be a trade war. He sited the following reasons:

1. China’s trade with USA grew from $2.5billion in 1979 to $532.6billion in 2017

2. China is currently the 3rd largest export nation to the USA.

He concluded by saying that even though the USA seems relentless in mounting pressure on China he does not foresee any trade which may eventually lead to a global recession. He was optimistic that this problem will be resolved.

Contact Us

08:30-11:30 | 14:00-17:00

Admissions Office: +86-511-88792366

Students' Affairs: +86-511-88792566

Teaching Affairs: +86-511-88792216

No. 301 Xuefu Road, Zhenjiang, Jiangsu P.R. China 212013